Payroll Protection Program - Here. (always be careful and check the https, there are reportedly already fraudulent websites collecting financial information).

Payroll Protection Program - Here. (always be careful and check the https, there are reportedly already fraudulent websites collecting financial information)."It's Going To Be A Mess" is the headline at Fortune Magazine.

As a recycler / junkyard operator, I'm in a rare position of having experience (as a regulator of 9 years at MA DEP) reading Federal Register rules, and know that this morning the "FINAL" Rule on the PPP - Payroll Protection Program - is not going to change. We started the application early, and had applications ready for submittal by last Thursday. But we've had to redo the application twice already.

But now it's final.

Here's what makes this blogworthy. My company has 30 employees (positions, some are vacant or seasonal). This program will lend my company money to continue payroll, and the portion of the money actually used / documented to be payroll will be eligible in ~6 months for forgiveness. Even the portion not forgiven will only be

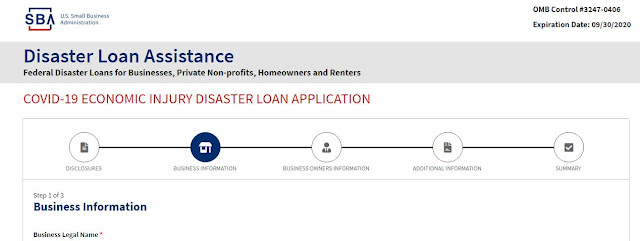

Here is the link to the loan application. I have been pursuing it NOT JUST FOR MY OWN COMPANY. I am making calls to any company we carry an A/R or A/P with, as my future income and future required services requires THOSE companies remain in business as well.

Our very first application was direct to the SBA(7) loan program... that's now in the recycling bin. It allowed loan calculations for things like rent and utilities and "at risk" receivables and payables. The feds probably correctly realized that program was front-loaded for weak businesses... most of the money would be lent to companies in the worst shape. And that can be money down a rat hole.

Instead the PPP Application now directs your recycling business to fill out the form and supporting documentation and deliver it to your local bank, wherever you have the best existing credit.

Ok without further ado, here's my take: A major portion of this "Loan" is effectively a business "Grant", and you are a fool not to apply for it. (But there's a catch)

- Feds defer the credit application to private banks.

- Feds provide those banks a formula for how to fairly distribute the loans.

- That formula is based on 2.5 times average monthly wages from trailing 12 months.

- ** conflicting guidance on which trailing 12 months to use, last I checked it was January 31, 2020. 10 Hours Later, not a single banker or government lender or SBA officer has been able to answer this question...

- I WILL UPDATE WHEN I FIND FINAL LANGUAGE.

- The application starts with "qualifying" questions, like "are you a drug dealer"? which you must check the box and initial it.

- The loan amount is based on the average monthly payroll (no private subcontractors as they are eligible to apply and would risk "double dipping", but health insurance, vacation is allowed)

- Take the average monthly payroll, e.g. $75,000, and multiply by 2.5 = $187,500

- Once your company receives the loan, CAREFULLY document three things that MAY be "forgiven" - payroll (incl health insurance benefits etc), rent, and utilities

- No interest accrues on the loan for 6 months.

- At the end, you will be able to file a SECOND, yet to be written application, for LOAN FORGIVENESS.

- Don't send the application to your bank until they say they are ready to receive it - a lot of bank staff are working from home and your document might get lost.

- DO NOT COMMINGLE THE FUNDS IN YOUR OTHER BUSINESS ACCOUNTS. See new language warnings in red below!

I am still trying to figure out the time period the loan forgiveness will be calculated against (earn out period), but "essential services" companies like recyclers and private data destruction companies will have an advantage. Imagine receiving the loan if you are a restaurant or conference organizer... you'd appreciate the low interest, but how are you gonna ramp up payroll to be forgiven? You'd essentially be paying employees to work from home, when there's no work to do.

I am still trying to figure out the time period the loan forgiveness will be calculated against (earn out period), but "essential services" companies like recyclers and private data destruction companies will have an advantage. Imagine receiving the loan if you are a restaurant or conference organizer... you'd appreciate the low interest, but how are you gonna ramp up payroll to be forgiven? You'd essentially be paying employees to work from home, when there's no work to do.

And that my friends leads you back up to the Fortune Magazine article, it is going to be a mess. UPDATE: The Final Federal Rule has contradictory language concerning use of the funds on pages 16-17 which undercuts my previous understanding (previously also verified by state bank who read the previous rules). Originally, the use of the funds for payroll only dictated the amount which could be FORGIVEN (essentially the grant portion), and the language governing FRAUD referred to SBA statutory language which was more open ended. The new, Final Rule has added language on the end pages implying that using the funds to pay interest on a credit card bill is allowed, but that if you use it to pay principle on your credit card, they may now define that as criminal fraud.

(THIS PUTS SHUTTERED BUSINESSES IN A RIDICULOUS CATCH-22, AS CREDITORS CAN STILL GO AFTER THE BUSINESS FOR DEBTS THEY ARE NOT PAYING AND THERE'S NOTHING TO PROTECT THE BUSINESS FROM LOSING THE LOAN MONEY TO AN OUTSIDE JUDGEMENT, IN WHICH CASE THIS LANGUAGE WOULD RENDER THE BORROWER GUILTY OF FRAUD).

My business already has a separate bank account used only for payroll purposes, so theoretically we can place the funds in that account, and it saves income from the company to spend on "unauthorized" uses (like fueling a truck). But that kind of makes it ridiculous as a requirement in the first place, unless the Feds are going to apply a stopwatch - 3, 2, 1, SPEND ON PAYROLL for 8 WEEKS... NOW STOP!"

(THIS PUTS SHUTTERED BUSINESSES IN A RIDICULOUS CATCH-22, AS CREDITORS CAN STILL GO AFTER THE BUSINESS FOR DEBTS THEY ARE NOT PAYING AND THERE'S NOTHING TO PROTECT THE BUSINESS FROM LOSING THE LOAN MONEY TO AN OUTSIDE JUDGEMENT, IN WHICH CASE THIS LANGUAGE WOULD RENDER THE BORROWER GUILTY OF FRAUD).

My business already has a separate bank account used only for payroll purposes, so theoretically we can place the funds in that account, and it saves income from the company to spend on "unauthorized" uses (like fueling a truck). But that kind of makes it ridiculous as a requirement in the first place, unless the Feds are going to apply a stopwatch - 3, 2, 1, SPEND ON PAYROLL for 8 WEEKS... NOW STOP!"

Banks are nervously asking the Feds "what if the companies just take this money at 1% and use it to pay off the 7% APR truck financing loan that our bank makes money on?" Well, I understand the bank's concern, but they got bailed out the last financial crisis, and if our recycling businesses and restaurants and moving companies are not bailed out, they'd have a non-performing truck repossession loan instead. This is how liquidity works... our companies did benefit from the bank bailout (we'd have had no one to finance our trucks) and the banks benefit from our being bailed out (no one would be paying their truck loan). Bernie Sanders is a kindly old Senator, but he is clearly confusing a lot of people about bailouts.

Be informed. Some banks have sent out somewhat confusing "guidance documents" that obfuscate between the payroll the loan is calculated from, the payroll portion that will be potentially forgiven/granted, and the legal use of the money. The money cannot be used illegally, but the money can be used to pay for rent, business expenses, debt to other vendors. You just have to pay interest - 1% APR for my company in Vermont (bank is adding 0.5% to SBA's 0.5%). I NOW SUSPECT THESE BANKS MAY HAVE HAD THE FRAUD LANGUAGE CHANGED YESTERDAY TO PREVENT THIS.

Finally, just to reinforce a point made above, the APPLICATION is made to a private bank, who is guaranteed safe from non-payment by the SBA. But you are not receiving federal money directly until you apply for the "forgiveness earn out" months from now. I saw some people getting concerned about making an error on the application form as if they were filing a tax document. The language (pasted at bottom) in the Final Rule explicitly holds the Banker harmless if there's an honest misunderstanding or mistake (but not fraud).

I'll update this as it evolves but wanted to get the links out to all my friends in the recycling community. Even my competitors. Because my life philosophy is that it matters what shape humanity and the world is in 500 years from now, and it matters what happened 500 years ago, and how much money I make in my >100 years in the middle is just a Seinfeld Frogger score.

"In the 1998 Seinfeld episode "The Frogger," George Costanza tries desperately to save the Frogger machine that holds his greatest achievement - the fictional world record score of 860,630 points. The episode ends with a battery-rigged arcade machine getting smashed in traffic in homage to the classic game, the record of the achievement lost forever."

No comments:

Post a Comment